I’m writing this article as I have spoken to quite a few instructors about investing. Firstly, I’m not a qualified financial advisor, so please do your research on top of what I share with you.

The things I do are not get rich quick schemes, but they are compounding/passive investments which so far have served me well.

I think after the many coronvirus lockdowns we had in the past, most people including instructors are wary of more unforeseen events in the future. As time passes, many will forget the financial worry they had during covid-19 and some of you will remember it forever. For those who have been scared for life, you may take interest in some simple investment ideas to make your savings work for you more in the background.

Investment ideas

I personally do a few things, and I hope some of them may help you; they all relatively low-risk investments. Treat investing like doing kick-ups with a football. If you keep doing it over a long period of time, you will reach 100 kick-ups!

This is also known as compounding.

High savings account

Holding onto cash roughly loses you 2% in a normal year. Even more during a financial crisis, when we have a cost of living problem. To counter this, you could put your spare money into a easy access savings account. At the moment most banks are offering 4-5% on your savings.

Vanguard ISA – Choose the S&P 500 or similar

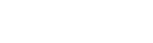

All you have to do is look at the S&P 500 graph to see it’s a safe investment over a long period of time.

You can set up a direct debit (which can be cancelled at any time) and invest £50 upwards a month.

The S&P 500 will usually give you a return of 10% plus a year. You will experience dips, but as long as you don’t panic and sell, you will see the recovery, and it will kick on. Also, if you keep your monthly direct debit set up, you will be buying into the dips.

Here is the S&P graph since it’s inception. There has been an unusual spectacular rebound since March 2020 where it crashed because of Covid. Regardless of any crash in history, if you are playing the long game with the S&P 500 and you making affordable deposits rather than lump sum payments you should comfortably ride any market crashes. This is called dollar-cost averaging/pound cost averaging.

Link to Investopedia: Investopedia

Link to Moneybox: Moneybox

Warren Buffet swears by this, and he is probably the most successful and most patient investor in the world.

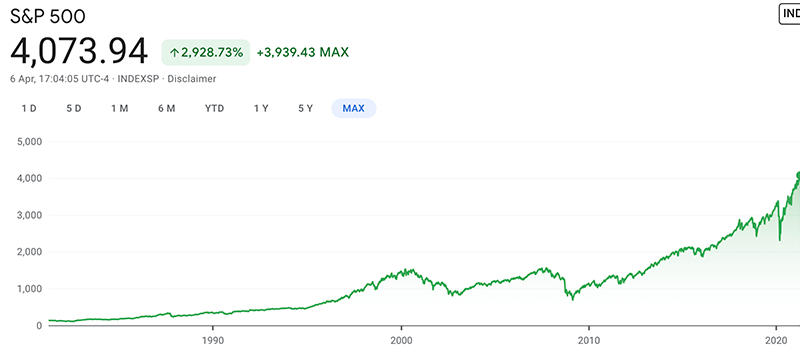

I have attached a screenshot of my average monthly investment into the S&P, and you can see the investment points. This account is roughly 12% up since the virus caused a worldwide market crash.

Click here to open a Vanguard account or find out more.

Details on the S&P 500 fund here.

Money Box

If you use debit/credit cards quite a lot, then download the money box App.

It will round up each transaction you make to the nearest £1.

For example, if you buy a newspaper for 75p, it will round it up to £1.

75p pays for your newspaper, and 25p is invested into your fund choice.

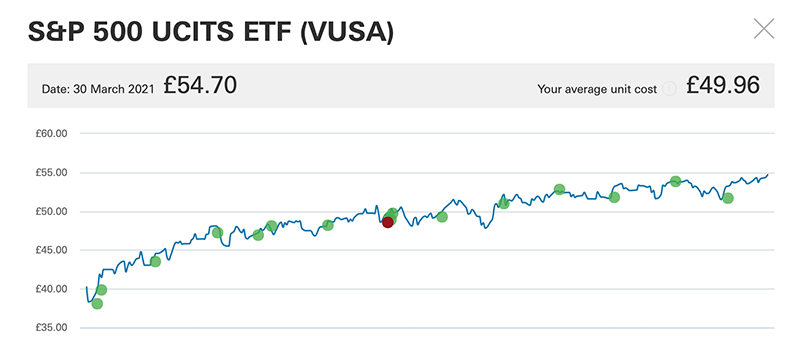

I personally use this, and the fund I chose was the adventurous fund. It’s currently up 10% right now, and during the worst time of the virus, it was down around 7%. After two months, it recovered. Nine months later, it is up 10%.

Money box is a great starting point if you are new to investing. It’s seamless and easy. If you start it now, you will be laughing in 10 years time.

If you start it now and want to cash in in 1 months time, you will obviously be disappointed.

Lifetime ISA

If you are looking to buy a house or are under 40 years old, you can benefit from 25% government contributions by doing a lifetime ISA.

The money can only be withdrawn for the following, so your money is tied up unless the following applies:

- to help buy a first home worth up to £450,000 at any time from 12 months after you first save into the account

- if you become terminally ill

- from the age of 60

Here you can find out more information on Lifetime ISA’s.

Keep some money aside for another market crash?

Warren Buffet always leaves 30% cash to one side for market crashes, so he can buy the dips. You should never invest all your money into one place as a general rule.

One good way of managing this is by doing the following:

- Invest into moneybox monthly, say £20 a month

- Invest into Vanguard ISA monthly, say £50

- Invest into Virgin 2% savings account, say £30

If there is a market crash, you can take your money from the virgin savings and invest in the Vanguard S&P 500, for example.

There will be another market crash when it happens – nobody knows. Many top investors believe it’s coming soon, and you can see by the actions of the stock market lately there is uncertainty. However, if you are playing the long game and not trying to mix it up with the Wall street daily investors, you will win in the long run and often beat the day traders who want to get rich quick – they usually lose everything unless they are an expert.

If you aren’t patient or you want to get rich quick, then non of the above is probably for you. I’m afraid you’re probably best waiting for the casinos to open.

I hope some of the above is helpful. I have been investing in all the above now for many years, and touch wood, they have all served me well, hence me passing this information onto you!

* I am not a qualified financial advisor. Please do you own research or seek a qualified financial advisor for further help. I’m happy to share my thoughts/ideas and what I do with anyone interested. Please feel free to get in touch with myself on my mobile for a chat.

Written by Anthony Johnson

Grade A - 51/51

ORDIT Registered Trainer